Your current location is:Fxscam News > Platform Inquiries

SEC approves BlackRock Bitcoin option, potentially boosting the Bitcoin market.

Fxscam News2025-07-22 21:51:53【Platform Inquiries】1People have watched

IntroductionHow to make money from foreign exchange,Foreign exchange black platform,Last Friday, the US Securities and Exchange Commission (SEC) approved BlackRock's Bitcoin Spot

Last Friday,How to make money from foreign exchange the US Securities and Exchange Commission (SEC) approved BlackRock's Bitcoin Spot Options (IBIT), which sparked strong market reactions and bullish sentiment. The IBIT options adopt the American exercise style, allowing holders to exercise their rights at any time before the expiration date, further enhancing the product's flexibility and appeal. Although the SEC has approved this option product, it still awaits further approval from the Options Clearing Corporation (OCC) and the Commodity Futures Trading Commission (CFTC), both of which have not yet provided a specific response time.

The Bitcoin market has received significant attention in recent years. As the world's largest cryptocurrency by market value, its price volatility and market participation have made it a favored risk asset among investors. The introduction of Bitcoin ETFs and related derivatives offers institutional investors a new avenue to enter this market, increasing its liquidity. The IBIT options are seen as an important hedging and risk management tool that not only helps investors cope with Bitcoin price volatility but also effectively manage the risk exposure of Bitcoin-related positions.

Experts generally believe that the SEC's approval will have a profound impact on the Bitcoin market. Eric Balchunas, Senior ETF Analyst at Bloomberg, pointed out that the approved Bitcoin ETFs will inject more liquidity into the market, attracting more large institutional investors. Jeff Park, Head of Strategy at Bitwise Alpha, is also optimistic about this product, predicting a possible explosive growth in the Bitcoin market. He stated that BlackRock's Bitcoin options will bring enormous demand growth for Bitcoin by providing more tools to help investors enter the market, driving its price to rise rapidly.

The Bitcoin market has experienced several ups and downs in recent years, from the surge in 2017 to the new high in 2021 and the subsequent adjustments and pullbacks, indicating significant volatility. However, with more institutional funds entering and the continuous enrichment of related financial products, the market is gradually maturing. The approval of Bitcoin ETFs and options products not only provides institutional investors with more investment and hedging tools but also marks the gradual recognition of the Bitcoin market by the mainstream financial system.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(85228)

Related articles

- How should one transfer accounts in XM? How does one change agents?

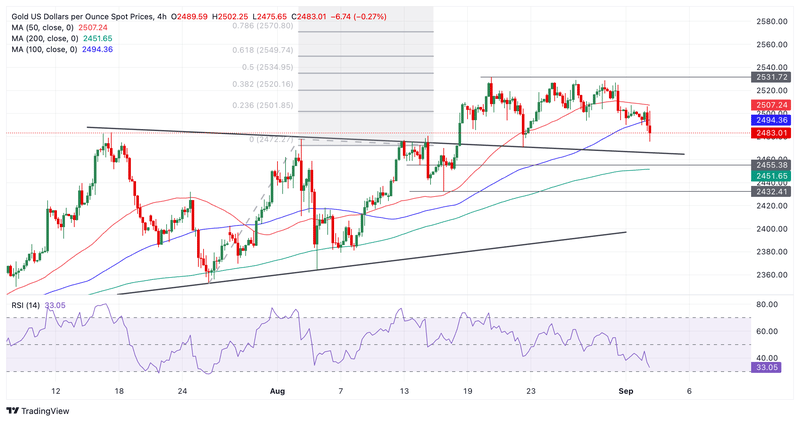

- Gold's downside may be limited; key support near 2438.8 warrants attention.

- Gold prices surged over 1%, driven by two key factors, sparking strong momentum

- Fed's policy outlook pessimistic, oil prices down three days in a row.

- ALB Prime Platform Review: High Risk (Suspected Fraud)

- Iron ore futures have fallen to new lows.

- Iron ore futures have fallen to new lows.

- Soybean and corn prices are sharply dropping in global markets, with the cause still unknown.

- Market Insights: Jan 18th, 2024

- Oil prices drop to a weekly low; Powell's speech and Jackson Hole meeting are key this week.

Popular Articles

Webmaster recommended

Is Reynold International Securities Ltd a Scam? An Exposé on a Fraudulent Forex Broker

Tesla significantly reduces Model Y production, possibly seeking a rapid transition

The price of Ethereum has recently dropped by 11%

Bank of America foresees rising U.S. inflation and a commodity bull market.

GSG International Limited Review: High Risk (Suspected Fraud)

Why did CBOT positions turn bearish, and why did positive market factors flip negative?

Oil prices rebounded, but the outlook is bearish. Watch OPEC+ and geopolitics

The price of palladium has recovered.